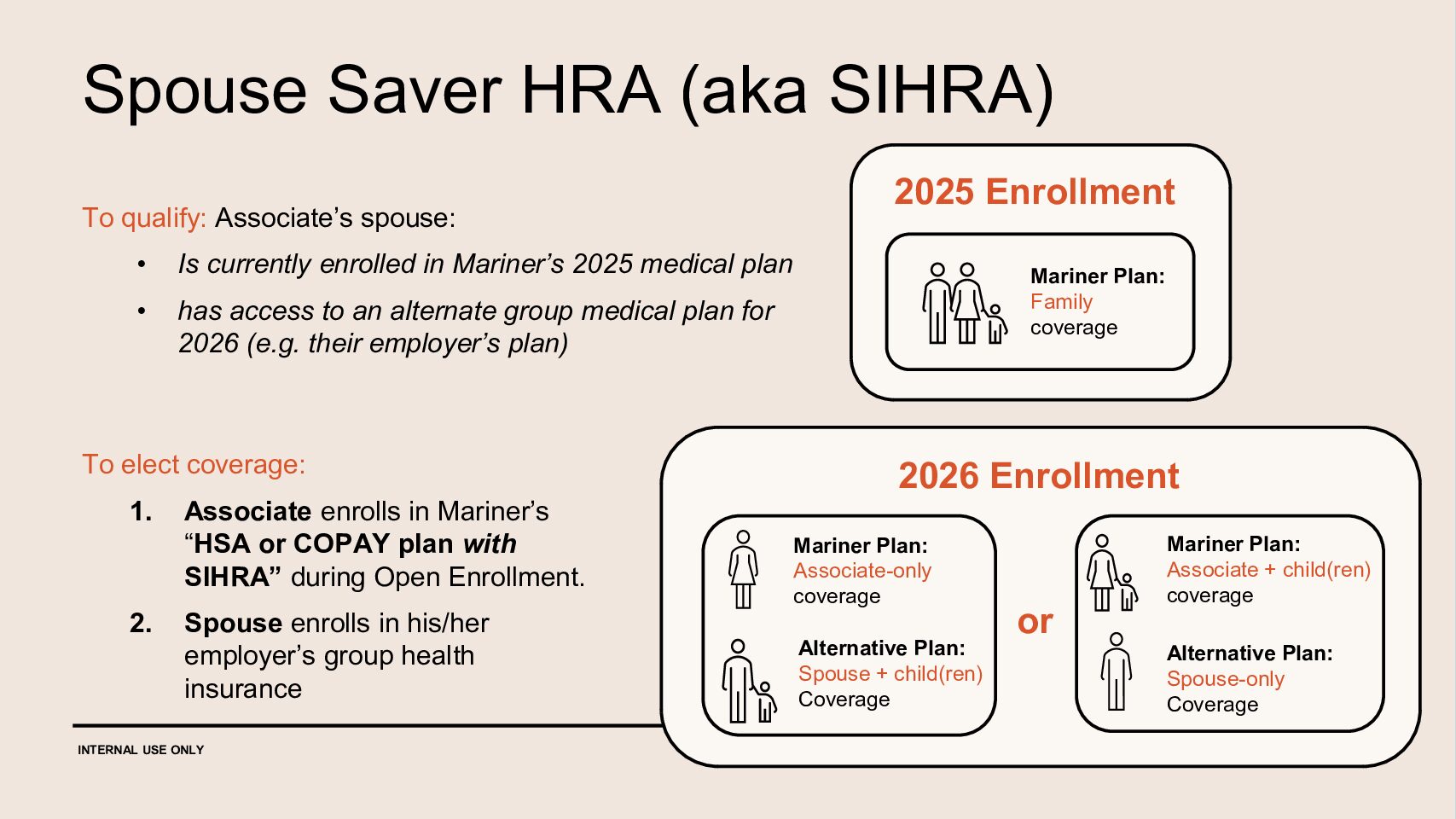

Spouse Individual Healthcare Reimbursement Account (SIHRA)

A Spouse Individual Healthcare Reimbursement Account (SIHRA) is a company-funded benefit that reimburses eligible healthcare expenses for your spouse or spouse + child(ren) who are enrolled in an alternative health insurance plan, such as their employer’s plan.

A SIHRA helps cover health insurance costs when your spouse has access to their own coverage elsewhere.

Instead of enrolling your spouse on the Mariner health plan, Mariner will provide money through the SIHRA to help pay 100% of your spouse’s eligible in-network expenses up to the annual out-of-pocket maximum.

855-890-7239

SIHRA:

- Covers 100% of eligible in-network expenses up to the annual out-of-pocket maximum

- Expands your choice of coverage options and provider networks without losing Mariner’s investment in your family’s coverage.

- Reimbursements are tax-free

- Not compatible with Medicaid, Medicare, Tricare or coverage through the ACA exchange.

- Cannot make contributions to spouse’s HSA plan.

Frequently Asked Questions

Do I need to designate a beneficiary?

A beneficiary does not need to be designated for SIHRA benefits.

I am leaving the plan, when does my coverage end?

Coverage will end the last calendar day of the month.